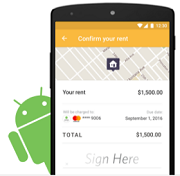

Pay Your Rent By Credit Card for Free Through 2016 with RadPad & Android Pay

Through the end of 2016, you can earn points or cash back when you pay your rent! This offer comes to you courtesy of RadPad, a photo-based rental listings mobile app. One of the services RadPad offers is allowing renters to charge their rent to their credit card. In turn, RadPad sends the landlord a check, but they normally charge a 3.49% fee for the service. It just announced, however, that through the end of the year, it would be waiving that fee when you use Android Pay.

Through the end of 2016, you can earn points or cash back when you pay your rent! This offer comes to you courtesy of RadPad, a photo-based rental listings mobile app. One of the services RadPad offers is allowing renters to charge their rent to their credit card. In turn, RadPad sends the landlord a check, but they normally charge a 3.49% fee for the service. It just announced, however, that through the end of the year, it would be waiving that fee when you use Android Pay.

» Read more